Despite his growing businesses in France and Britain in the 1960s and 1970s, Sir James was still not regarded as ‘one of us’ by the establishment: partly because of his advanced and visionary methods of business, and partly a result of his provocative statements to journalists, which he relished making. In 1972, for example, Sir James caused a furore when he correctly predicted there would be a slump in the market.

At this time, he began to consolidate his assets, fearing a bust after the great boom of the previous few years. Just as it had been when he predicted the boom in 1963, his timing was perfect. His prudence ensured he survived the mid-1970s stock market crash when many other great takeover merchants went bust – including Jim Slater of major securities and banking company Slater Walker.

In 1975, Sir James took over as chairman of Slater Walker in a successful bid to limit the effects of the company’s failure on the wider economy, and his own businesses.

During this time, as he was also looking to become a newspaper proprietor, Sir James saw that being involved in both manufacturing and retailing food products involved a fundamental conflict of interest. Believing there were also major problems with the UK and European economies, he decided to liquefy his food manufacturing interests, selling off Bovril and other businesses in Europe for a significant profit of about £100m, and focus solely on retail.

In 1980, he resigned as chairman of Cavenham, signalling his exit from the UK, and began looking to the US for his next challenge, where the biggest merger boom of all time was just getting underway. He soon became one of the boom’s greatest players, with a simple strategy: buy badly-performing companies with undervalued assets and turn them around.

Read more in archive

Other investments

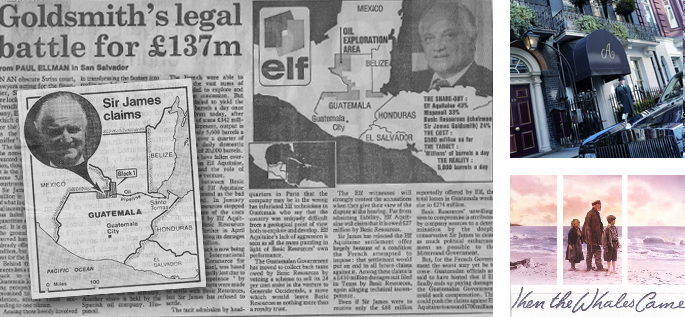

Oil in Guatemala: In the early 1980s, Sir James decided to invest in Basic Resources, a company formed by veteran oilman John Park to conduct oil exploration in Guatemala. Park had also bought in French state-owned oil company Societe Nationale Elf Aquitaine.

After making himself chairman of Basic, Sir James spent a month negotiating a new deal with the military government. As his own investment rose to $45m, he then found himself in a prolonged battle with Elf following rumours the state-owned oil company was trying to force Basic out by sabotaging its own operations. Sir James decided to sue, and eventually settled for $130m in damages and a significant royalties guarantee, the largest settlement in French history up to that point. Having recovered all the money he had invested and some more, Sir James remained a 10 per cent shareholder in the company, with his banker Gilberte Beaux appointed as chairman.

Aspinalls: Sir James financed part of his old friend John Aspinall’s luxury casino, Aspinalls, in the premises of the old Curzon House in Curzon Street. A £625,000 investment in 1978 became a 40 per cent stake in a company valued at £60m when Aspinall floated it on the stock market in 1983.

Offshoots: In 1987, Sir James also investigated Pan Am Airways, but pulled out after deciding the investment would not be worth his while. The following year, he dabbled in the film industry, financing part of the feature ‘Why the Whales Came’.